3 Min. Gold News

You’re thinking of the future. Of changes. Of safely getting from here to there.

All the world’s tit for tat settles on a trifle of gold.

The BIS Quarterly Report Media Q & A

Main Theme

Strong US Dollar

Commodity Market Margin and Volatility

Interest Rate Rise Lead to a US & Eurozone Recession?

Corporate BBB Bonds Systemic Risk

Opaque Credit Markets

Sustainable Bonds

CBDCs

BIS Website Quarterly Report Media Q & A

MAIN THEME

The main theme of this quarter is the diversity of outcomes across economies.

(The alarming widening of the gap between the rich and poor.)

Emerging economies have faired ‘quite well so far’. Those who produce commodities are fairing better.

Japan and China have lowered their interest rates, but world monetary policies are ‘coming together’ as they tackle inflation.

Big issue now is how the monetary policies will affect exchange rate movements.

STRONG U.S. DOLLAR

The US dollar has strengthened to multi-decade highs against the major currencies and some emerging currencies.

A stronger US dollar tends to put upward inflation pressure on other economies.

Historically this is the case.

That means there will be more need elsewhere to tighten monetary policy.

The BIS says they know “where the channels are”.

A stronger dollar tends to tighten balance sheets elsewhere – particularly in emerging market economies, which are more vulnerable to this phenomenon. Although, there are big differences among emerging market economiies.

“This could put added pressure to tighten monetary policy to prevent a big depreciation.”

“This could produce an additional tool, foreign currency intervention, as it has already in a number of countries.”

COMMODITY MARKET MARGIN AND VOLATILITY

The prices of natural gas and electricity spiked just after Ruussa went iinto Ukraiine, but they have come down.

There are financial forces working in these markets that not only reflect the underlying economic funamentals, but also tend to amplify these kinds of shocks.

The authoorities have unveiled various liquidity support measures to sustain energy firms through stress. It’s more about the maturity mismatch rather than the underlying cashflows. ie you hedged by selling your output forward, then the margin calls came on a daily basis – that’s an example of a maturity mismatch.

In those cases it’s about the liquidity rather than the solvency, because those cashflows will be coming eventually. For these reasons authorities have rolled out various schemes. They typically involve a commercial banking sector together with some kind of a guarantee that is provided by the government.

There’s an issue about margins during normal times as well.

There are lessons to learn during normal times to lessen these liquidity stresses.

CENTRAL BANK TIGHTENING LEAD TO A US AND EUROZONE RECESSION?

When will CBs consider stopping the tightening given the economic slowdown?

The path is quite narrow.

(Raising interest rates lowers demand because people have less credit available to buy things, and the cost of the payments is too high.

There’s going to be a hard landing or a soft land, but this economy is going to land.

This is the end of cheap money and cheap labour.)

We’re seeing tightening in order to deal with inflation.

While we’re also seeing vulnerability because of very high debt both private and public, as well as rich asset prices, in particular the real estate market.

Historically, high levels of debt = hard landings.

Front loading tends to reduce the liklihood of a hard landing.

So central banks need to raise rates fast and hard.

This will, unfortunately, have short term costs because monetary policy operates by cutting/constraining aggregate demand to re-equilibrate the demand with the capacity of the economy to produce.

Historically, if you wait and don’t deal with the problems, and allow inflation to become entrenched, this will raise the cost further down the road. So we have to act in a timely and forceful way.

CORPORATE BBB BONDS SYSTEMIC RISK

Investment grade corporate bonds indicies have grown riskier over time.

We and others have drawn attention to this for some time.

(Many funds are required by law to hold investment grade bonds.)

The specific problem with BBB segment is that many investors are constrained to invest in investment grade category, and the triple B are at tthe bottom of that category.

So if you get some downgrades you can get some cliff effects, with investtors having to sell off their assets, either because you have a downgrade, or because they expect a downgrade to happen.

This is clearly another source of vulnerability out there in the financial markets.

OPAQUE CREDIT MARKETS

There are rather opaque corners in financial markets in the credit space.

They need to be watched and monitored more closely.

One of those is the private credit market.

Equity markets adjusted quite a lot in the most recent sell offs but credit markets have not.

RECESSION RISK

Since the last A & Q growth forecasts have been revised downwards and inflatioon forecasts have been revised upwards.

Clearly the risk has increased.

The extent to how much the risk has increased depends on the country.

The countries that are more vulnerable to the energy problems are clearly more vulnerable to the risk of a recessioon.

SUSTAINABLE BONDS

Sustainable (green) bonds is a new asset class.

The sovereign nation chooses the benchmarks and if they meet them then they can lower the cost.

It’s a nation-by-nation basis.

If a GDP bond were tied to incentives and penalties for meeting goals, then data would not be reliable as there would be an incentive to fudge the numbers.

“With SLV the data would receive more scrutiny by the outside. The indicators would be global.”

“These bonds are linked to the fungibility of the use of the proceeds by the sovereigns.”

“It is a clever way of doing so, and linking it to the overall objectives of dealing with climate change.”

The credibility of the penalties is a key issue.

They have been a catalyst for private sector issuance, as the governments have voluntarily subjected themselves to tougher standards, which have been extended to the private sector. Especially in evidence in the energing market economies.

(Nations are agreeing to accept open serveilience of the data re: these bonds in exchange for profit from BIS. The BIS is given the power to control how the proceeds are spent by the sovereign nation. Doesn’t sound very sovereign.

(They openly state this is a catalyst for the private sector. Is this the CBDC template? The BIS gives the private entity or citizen ‘money’ in exchange for open servellence of all data and agreement to spend as the BIS allows. Only the desperate would agree to such severe and oppressive terms. The sovereign or citizen would only agree if tthey saw no alternative or had a complete lack of hope.)

……………………………………….

Nothing on this site is intended as individual investment advice. We’re all watching which way the wind is blowing.

……………………………………….

My thoughts for today…

I read and study the Bank for International Settlements speech transcripts each day.

My purpose has been to understand how the current system works, the winners and losers, the triumphs and mistakes, and the cover-up or obfiscation of mistakes in order to try something new.

I’m just thinking of the future. Of changes. Of safely getting from here to there. ;)

I keep in mind Jim Rickards’ statement that these are very intelligent people with wrong models, as they don’t spend time in the real world of the masses who produce goods and services, travel, build their lives and make self-sovereign decisions to the best of their abilities.

But lately, within the last year especially, the tone of the central bankers has changed.

The head of the central bank for central bankers recently said thatt “human labour” may now have a “reduction in quantity and quality”. He admitted a mistake in stopping the world economy “mid-air” thinkiing they could restart it again on a dime.

Janet Louise Yellen has joked that they didn’t take away the punch bowl of free money soon enough.

When the General Manager of the Bank for International Settlements, Carstens, speaks they all listen and follow instructures, said as suggestions. Immediate hard interest rate hikes. Tax the citizens more as build a ‘resilience’.

The central banks are buying physical gold in a less quiet and increased level..

They want/need control over supply.

Central banks don’t have any control over supply. They have no policies to increase supply of labour, goods or servies. They can only manipulate demand by increasing interest rates.

SThey need to drop demand because there’s less supply. So they raised interest rates, so less people will want goods because they can’t afford to pay back the higher interest rate payments.

Get it? There is no free market on a global level at this time.

Carstens says he’s worried about a crisis/protests/loss of control, while tensions are being stoked and food plants are coincidentally burning down. The crashing of a financial system and inability to provide food, energy or heat for your family would inspire many to need direct help.

But it’s a delicate plan they have. I’ve read in two different speeches now that the very central banking model is at stake. They are concerned. They say they all have to work together – all participants, being all nation governments, all commercial bankers, central bankers and non-government players who are not named publicly.

Singapore’s economy is doing okay now, but “the future is strongly dependent on the 3 main, final demand markets – China, ASEAN-5 and the US.”

Growth won’t come from imports. It depends on domestic production and travel.

……………………………………….

Janet Louise was spinning with ease,

queen of the ballroom scene,

but her soiree was doomed

when the punch was consumed

and free refills guaranteed.

Janet Louise eager to please,

the board (bored) of the ballroom scene,

abandoned her chair

to join the affair

and dip to their Lindy Hop dream.

Elaine~

©2022 Elaine Diane Taylor words | music

……..

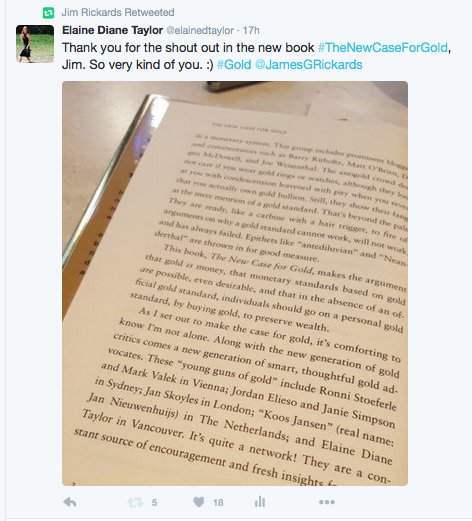

Thank you to Jim Rickards for including me in his bestselling book The New Case for Gold.

……………………………………….

Nothing on this site is intended as individual investment advice. We’re all watching which way the wind is blowing.

……………………………………….

Thank you to Mike Maloney for including my song Coins and Crowns in his bestselling video series Hidden Secrets of Money episode 1.

Coins and Crowns

words and music Elaine Diane Taylor

SOCAN/ASCAP

from the album Coins and Crowns

And, thank you also to Mike Maloney for including my song Helicopter Ben in his YouTube video The True Legacy of Bernanke.

……………………………………….

Not Much of a Holiday (Bank Holiday, Ice 9 and Media Persuasion)

words and music Elaine Diane Taylor

Single available on iTunes

……………………………………….

A Terrible Breeze (War and Social Media)

The news comes down

A little bluebird sings

Words of war

Fire and furious things

Of testing might

‘Til no patience knows

If keeping still

Still keeps you safe at home

It’s a terrible breeze

They speak of today

Of threats that used to live a world away

We all know wind

Can blow both ways

And a terrible breeze can blow it all away

A worldwide net

Sees our village grow

Until we all forget

What each one used to know

How a blind bird’s wings

Can reach the shore

And turn the wheel of peace and war

Village fools sinking down, down, down

Debt and gold wound in numbered shrouds

Deal of a life it’s bread and clowns

Can we afford another go around?

The news comes down.

It’s a terrible breeze. The news comes down.

words and music Elaine Diane Taylor

Single available on iTunes

Thank you to David Crosby for telling me in a Twitter DM:

“Lyrics are the hardest part and yours are excellent…music’s good to.”

……………………………………….

Preparing for the Fall is a live boutique album available for digital download — featuring Wag the Dog, Black Swan Dive, American Pie and Gods of the Copybook Headings. Also available on iTunes, Google Music, Amazon Music and major digital distributors.

……………………………………….

The Gods of the Copybook Headings

words by Rudyard Kipling and music by Elaine Diane Taylor

from the album Preparing for the Fall.

The copybooks of the early 1900s gave us all the wisdom we need. The sayings that were copied are the truths, the gods of our world. All the empires who followed the gods of the marketplace have fallen, and there’s terror and slaughter when the gods of the copybook headings return. The lyrics are by Rudyard Kipling. One of my gurus.

Another Week on Wall Street

words and music Elaine Diane Taylor

from the album Coins and Crowns.

“A little grease (Greece) is floating out to sea, and little pigs (Portugal, Italy, Greece and Spain) are bobbing up and down, they’ll send a storm and we’ll see, when the tide goes out who’s naked on the beach“. The world is changing as we know it.

……………………………………….

Nothing on this site is intended as individual investment advice. We’re all watching which way the wind is blowing.

……………………………………….