3 Minute Gold News

gold lays still while the whole world swings hard

THE BIS

BRICS

BASEL III

WAR

BITCOIN

GLOBAL FINANCIAL RESET

MEME COINS

The BIS spoke recently at a private meeting of the International Institute for Banking Research (IIBR), an elite group of European bankers.

The central banker for the Netherlands, Klaas Knott, very strongly cajoled the bankers, saying they needed to get on with implementing Basel III, which the banking world agreed to 13 years ago and still hasn’t implemented.

Basel III is a set of regulation where commercial banks use more of their capital as a safeguard against bad times instead of using it to make a profit.

Knott says Basel III will make a level playing field and help everyone be safer.

So, as the world is moving away from a centralized top-down global rule, and is moving towards a decentralized smaller regional and national rule, this central banker wants the commercial, profit-based bankers to volunteer to make less profit for the good of the current global system.

The current system is quickly unraveling.

A new system can be negotiated into or forced by the most powerful.

“We’re all in this together.” no longer is believed.

If it ever was.

Those with an advantage inside a closed system with a tilt in their favour do not want a level playing field.

All players in all games want the higher ground.

In warfare, all parties want the higher ground as it gives an advantage of sight and movement.

Relatively speaking, the player with the lower ground wants a level playing field to in order to get up higher – to get an advantage from where they’ve been.

In other words: They’re looking to gain advantage.

Pretending your adversary is a friend, and you’re just playing a game, so they should give up their advantage to be nice, is a tactic, if not a complete strategy. You wouldn’t do this if you were playing a game where you were currently winning and didn’t trust the other players.

Knott is telling the powerful bankers that they need to give up advantage, and that as a group they should work together to safeguard the greater financial system.

His point is that if they don’t all work together then the system they’re winning in could fall apart.

But if that happens then the individual bank will work with those they trust, instead of with a greater system that is in chaos.

The current system is filled with unsustainable debt and favours and backroom deals.

No one gives up an advantage in a rotting system that’s about to collapse.

That only works where there is trust.

And there is no trust. None.

This will only happen if the alternative is for each banker to lose by not joining in.

That would only happen, maybe, if there was a Hail Mary play to avoid world war. Then again, war can benefit an individual bank.

And it would only work to avoid collapse if every bank followed Basel III.

That’s not human nature. If one bank doesn’t comply then those wanting to gain the most would just move their money to the place with the least rules.

This is how global capital flows. It moves, quickly, to where it can make a profit.

Digital currency and assets, such as Bitcoin, Ethereum, XRP and many others, can be moved in a decentralized fashion in minutes if not seconds.

If the owners think one place is a risk they’ll just move it for a low fee without a wait.

In a centralized, controlled society the players are forced to share, with only the rulers getting extra. But communism never works, because without an incentive to do more than the minimum the whole system crumbles, as there is no reason to extend personal energy to improve the technology, or to give power to those who could come back and take you over.

There will always be others from outside the system who are innovating to gain an advantage, and the organic system made up of humans will do what humans have always done – they will seek to gain for themselves and their families.

There is overwhelming debt created by those in power, without the means or desire to ever pay it back.

The debt payments are made by borrowing more to make the minimum payment.

That global Ponzi game stops when no one buys the new debt.

Then, historically there is a war.

The winners default on their debt to the losers, and all those with power get together afterward to make a new set of rules with new currency.

A reset.

All systems rise, peak, and fall.

All empires, all seasons, all closed systems rise, peak and fall.

The enduring ones flow with the cycles, plant in the spring, enjoy the summer, prepare for winter, and cut back in the winter. They become more efficient so they can plant seeds more efficiently in the next spring.

Some nations are doing that now.

That’s Elon Musk’s aim with his D.O.G.E.: Department of Government Efficiency, if Donald Trump wins the Presidency.

For any nation to trust an outside power, without having safeguards looking after their own best interest, puts itself in a vulnerable position.

Players with advantage will collaborate for mutual gain, but have no reason to make new rules with the explicit aim of losing their own value for the good of all.

This is not human nature and not natural law.

If you give up sovereignty and self-defence how would you know it’s for your benefit in the future? Who would make the rules in the future?

In order for a larger closed system to gain size and power, each of the smaller systems inside it must work together as one, instead of competing against each other.

The alternative is to have one part of the smaller pieces conquer another, and force it to work within the larger system.

UNITED NATIONS

Rome did this. It conquered and taxed, but did not change the citizen’s culture or religion.

At this time, the United Nations wants one world government governed by them (unelected officials). To do this they must take from nations who have more, and give it to those who have less. The UN would decide how much you get.

A speech by Christine Lagarde a few years ago said they were going to make a bigger pie which all would split – a smaller amount to those who had and a bigger amount to those who didn’t have.

It didn’t go over well. Now the world is fragmenting.

The globalist dream is falling apart, and the BIS has now acknowledged that the world is fragmenting.

Lagarde just gave a speech last week saying Europe will be hit hardest of all open economies because it was the most globalist. They must prune and turn to new technology, which she says openly will create a large gap between winners and losers in the EU.

Citizens realized their leaders wanted them to give up their sovereignty and culture for what the globalists called the greater good. It wasn’t for the individual citizen’s greater good.

So, smaller nations are joining together to have negotiating power against the more powerful.

BRICS

BRICS met last week, gaining more members, and has reached a place where they must decide whether to stay as a group who wants to collaborate for mutual expansion, or become a group that seeks to overthrow the current system.

India has made it clear they want the former, as they still work with the United States with investment and new technology for mutual benefit.

China and Russia swing between veiled intimidation in a sabre rattling game of coins and crowns, and calmly negotiating for more advantage.

I mentioned in the last blog that they used their think tank arm to talk tough then throw out a line in the sand that talked of the United States having a monopoly over the global financial system, and how that power cannot stand in the coming reset of world debt and fragmenting.

WAR

Back to the BIS speech to the powerful European private bankers. Knott gave away the topic of the first speech of their annual meeting:

“By now, some of you might think: ‘okay, so this morning we got war for breakfast, and now for lunch we get a central banker who wants to talk about the rules…'”

So the bankers were told about war in their morning meeting.

BIS speeches talk of the geopolitical tensions growing.

Supply chains, the making and shipping of products, is moving closer to home, as the debt balloons, and promises and trust break apart.

This is a part of the social cycle.

Corruption grows over time as more backroom promises grow. When the losers get together they want to clean out the corruption and force a winter, so they have a chance at a better spring for themselves.

This global cycle is the public debt going into a winter, and capital moving to private companies.

Empires through history have swung from being ruled by public or by private.

We are in that swing.

For example, in Europe when they created the European Union, in order for the group of European nations to gain an advantage in world trade and power they needed to work together.

That meant the European nations with less gained in the coming together, and Germany (the one with most) needed to lose.

The German leader knew its citizens wouldn’t vote to lose their own hard earned advantage, so he just took Germany into the EU without a vote.

He made sure that the nations’ debts were not combined, which actually doomed the whole European Union. They have no combined bond market for international investment.

The central banker from the Netherlands came into the private bankers’ meeting to cajole them all into wanting to implement the rules of Basel III, for the good of all.

This is the difference between closed systems. The private bankers are one system, and central banking is another, all inside the bigger system of current global finance.

We live in an official two-level system of global finance.

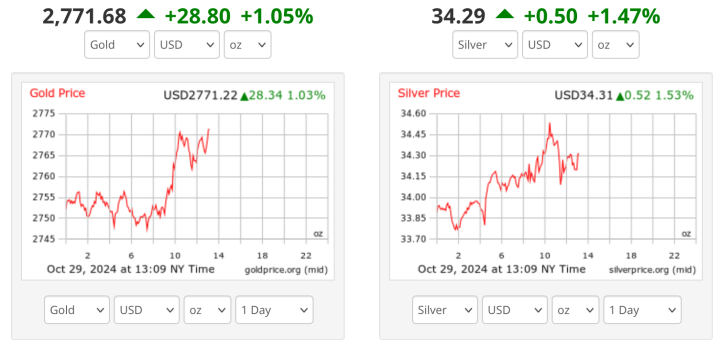

It runs on debt and settles in gold bullion.

But that system is coming to an end.

What will a new system be?

More decentralized.

That’s the greater cycle.

Central banks have rushed to hold physical gold because the trust is falling apart.

Gold has no brand, melt it and hold it, they can’t dilute it or falsify it, and therefore is a store of value that is part of having power at the table when they set up the new game.

That’s it for now,

Elaine~

Oh, on meme coins.

This is the forming, rushing and running away that is the cycle of the rise and fall of a teeny tiny empire done in days instead of a few hundred years.

Buyers who are strangers bond on a shared ideal, usually an irreverent one that tests the bravado of the buyers. It’s a game of chicken. But everyone knows going in.

The underlying rise and fall is the belief that others are idiots, who are not near as clever as you, and so you will take a profit before they will.

If you take it too soon you don’t get anything. If you wait then you don’t get anything and lose what you put it.

It’s a communication theory dream. Pull together individuals based on a common idea, and then watch the repeating pattern of the common idea breaking and the individual taking what they can for themselves.

That’s the game.

Some memes stay because there’s a big enough group bond, which moves like a longitudinal wave, as in quantum, as in a crowd, that a few who run can’t take a big enough chunk to sway the joined collective.

It’s a tribe that says, “you get it.” It separates us from them.

But everything is speeding up.

And that’s where the global society is swinging. From centralized to decentralized.

From mechanical to electromagnetic quantum.

It’s fascinating.

I’ll stop here.

Elaine~

edit: adding that mBridge is a pilot project by the BIS whereby digital ‘money’ moves across borders without using the US dollar inbetween. BRICS are a group of nations looking to bypass the US dollar in trade. mBridge allows this as it’s decentralized.

The proof of concept is finished. It works. Each nation has regulation that lets it trade with whatever central token is used. The nation trades in seconds with the central token, then trades the central token, again in seconds, for whatever currency they want. All digital. All decentralized.

mBridge could be taken down, but the concept has been proven and can be used without the BIS involved.

The genie is out of the bottle. The horse has left the stable.

E~

……………………………………….

Thank you to Jim Rickards for including me in his New York Times bestselling book The New Case for Gold.

……………………………………….

Nothing on this site is intended as individual investment advice. We’re all watching which way the wind is blowing.

……………………………………….

Gold is at historic highs because trust in government is at historic lows.

……………………………………..

Communication Theory….

As the alphabet took the magic of words and divided them into tiny repeatable units, strung along in written symbols that did not look like the sound, then reformed into words and meaning in the quiet of one’s own mind, so currency separates commodities and items of value into concise repeatable units.

The currency is packaged and shipped, identical, and is value as exchange for meaning of value to the receiver.

The oral societies are not led by the alphabet; they are led by the voice and ear. So each item is different, unique, and exchange is bartered over for each unit. These countries will not easily move to digital wallets and identical purchases. The unbanked are sometimes unbanked by choice.

Those in power talk about taking care of the ‘unbanked’. But the care is misplaced. A new bank account will earn the banker fees, and the expansion of the currency supply is not a desire of the central banking system, it is its lifeblood.

If the unbanked have a devise with a digital wallet then they can be tracked as data and aggregated for easier control. A retail CBDC in the unbanked hands can be programmed by the central authority to be used to the benefit of the center.

To keep their central bank system going they must have ever expanding borrowing and debt.

Their system has failed because it has to fail.

Sooner or later you run out of people to lend to, so they need to add the unbanked, and they’ve created a ‘green’ issue to make new reasons to create more debt.

The business cycle cannot be stopped; it rises and falls as every closed system does. They know this, and so those in power are rushing to cement control with new technology before the first out of the gate with new products beat them to market share. The rush is to try to regulate to keep the status quo.

But it’s impossible.

AI is the new race.

Humans want to control the data inputed believing their own control will keep them in control. No one has any idea what complex financial instruments will be created by generative AI. Controlled by itself. For whose benefit?

My biggest concerns at the moment come from Understanding Media, written by Marshall McLuhan. He writes of Nobel prize winning author Alias Canneti’s book, Crowds and Power, talking about the psychic effects of the Germany hyperinflation after the First World War.

The depreciation of the citizen went along with that of the German Mark.

There was a loss of face and of worth, in which the personal and the monetary units became confused.

When everything is mechanical, it includes thoughts, money and humans.

I hope that confusion doesn’t return.

Elaine~

……..

Thank you to Mike Maloney for including me in Episode 1 of his bestselling series Hidden Secrets of Money.

Coins and Crowns

words and music Elaine Diane Taylor

SOCAN/ASCAP

from the album Coins and Crowns

Coins and Crowns is featured in Episode 1 of Mike Maloney’s bestselling series Hidden Secrets of Money.

……………………………………….

Not Much of a Holiday (Bank Holidays and Media Persuasion)

words and music Elaine Diane Taylor

Single available on iTunes

……………………………………….

A Terrible Breeze (War and Social Media)

The news comes down

A little bluebird sings

Words of war

Fire and furious things

Of testing might

‘Til no patience knows

If keeping still

Still keeps you safe at home

It’s a terrible breeze

They speak of today

Of threats that used to live a world away

We all know wind

Can blow both ways

And a terrible breeze can blow it all away

A worldwide net

Sees our village grow

Until we all forget

What each one used to know

How a blind bird’s wings

Can reach the shore

And turn the wheel of peace and war

Village fools sinking down, down, down

Debt and gold wound in numbered shrouds

Deal of a life it’s bread and clowns

Can we afford another go around?

The news comes down.

It’s a terrible breeze. The news comes down.

words and music Elaine Diane Taylor

Single available on iTunes

……………………………………….

Preparing for the Fall is a live boutique album available for digital download — featuring Wag the Dog, Black Swan Dive, American Pie and Gods of the Copybook Headings. Also available on iTunes, Google Music, Amazon Music and major digital distributors.

……………………………………….

The Gods of the Copybook Headings

words by Rudyard Kipling and music by Elaine Diane Taylor

from the album Preparing for the Fall.

The copybooks of the early 1900s gave us all the wisdom we need. The sayings that were copied are the truths, the gods of our world. All the empires who followed the gods of the marketplace have fallen, and there’s terror and slaughter when the gods of the copybook headings return. The lyrics are by Rudyard Kipling. One of my gurus.

Another Week on Wall Street

words and music Elaine Diane Taylor

from the album Coins and Crowns.

“A little grease (Greece) is floating out to sea, and little pigs (Portugal, Italy, Greece and Spain) are bobbing up and down, they’ll send a storm and we’ll see, when the tide goes out who’s naked on the beach“. The world is changing as we know it.

……………………………………….

Nothing on this site is intended as individual investment advice. We’re all watching which way the wind is blowing.

……………………………………….