3 Minute Gold News

gold lays still while the world swings hard

An interview synopsis of Jim Rickards, New York Times bestselling author of The New Case for Gold, The Death of Money, Currency Wars, The Road to Ruin, Aftermath, Sold Out, and MoneyGPT with Daniela Cambone of the Daniela Cambone Show at ITM Trading.

Jim is the Editor of Strategic Intelligence, former general counsel for Long Term Capital Management, and a consultant to the U.S. Intelligence community and U.S. Department of Defence.

STABLECOINS

What is a stablecoin?

A stablecoin is a cryptocurrency that pledges to maintain a value of $1.

(The most commonly used ones are Tether and USDC, with others being created now in rapid succession.)

You can use the stablecoin inside the crypto world, and if you choose to cash it out, the creator pledges to give you back $1.

(In the volatile crypto world you are told that you can hold the stablecoin and it will not lose value.)

The sponsor who creates the stablecoin takes US dollars from the purchasers and mints the digital stablecoins.

(Purchasers can also swap into stablecoins from inside the crypto world using other cryptos, but they are asssured by the stablecoin creator that they can redeem their stablecoin for $1 fiat when they wish to.)

What do the stablecoin issuers do with the dollars they received? They buy an asset like a Treasury Bill, which is liquid and has a large market (to back the stablecoin and be able to redeem if requested).

The Treasury bills earn the issuer/sponsor about 3% yield which they keep.

The stablecoin owner does not earn anything when they hold the stablecoin.

(The Genius Act does not allow the stablecoin itself to earn a yield.)

So, why do people purchase the stablecoins if they don’t receive a yield?

The answer is that they can use the stablecoin to buy other cryptos like Bitcoin, Solana and many others inside the crypto world, which they ARE looking at to make money on.

(When their Bitcoin, Solana and other crypto are falling in price the owner can easily swap into the stablecoin which pledges to hold a $1 value, wait until they believe their chosen crypto will begin to rise again, and swap back into that coin without exiting back into fiat money.)

This is a way for the US government to keep selling Treasuries, even as other nations are getting out of this US debt.

RUSSIA

There was a recent Russian critique saying that the US government will devalue the government debt which backs the stablecoins, and the world population that purchased the stablecoins will then be left with an investment that is worth less.

This is not correct.

TREASURIES

The world is not dumping Treasuries.

The Treasury International Capital (TIC) report shows all the nations’ central bank holdings of Treasuries. It’s published each month.

There is no big selling off of Treasuries by other nations. It’s been very stable lately.

Even a year ago, when China and others were selling, it did not show they were getting out of US dollars.

Instead, it showed that there was a shortage of US dollars, and they were selling the Treasuries to get dollars.

Treasury securities denominated in US dollars backs 60% of all global reserves (savings). It’s not US dollars in the reserves; it’s Treasuries denominated in US dollars.

So, when China sells US Treasuries they get US dollars, which they use to prop up their country’s currency and their businesses.

They need the US dollars to spend to do this.

GOLD, RUSSIA, EU, NATO

Central banks have been net buyers of gold since 2010.

They’ve increased their buying of the metal mainly because the US has weaponized the US dollar by using it for sanctions.

The European Union has also weaponized the system by adding sanctions against Russia.

But all of the sanctions have failed.

The Russian ruble has been the best-performing currency in 2025.

This is because many countries did not join the sanctions and continued to trade with Russia.

These countries see the US and NATO sanctions, and they can see the US dollar being used as a weapon.

They also see that $300 billion of Russian assets that were held in US securities in Europe are in the process of being stolen.

So global trading partners take a look at that, and don’t want to have that happen to them if the US is unhappy with them in the future.

So nations are buying physical gold.

Russia put 25% of their reserves in gold bullion.

This gold can’t be seized without invading.

The gold is physical and not digital.

Gold doesn’t go through the SWIFT or the FedWire digital financial payment system.

That’s why nations are buying physical gold.

Nations also have very large US Treasury holdings.

The US Treasury market is doing fine.

Interest rates have dropped and people are scrambling to buy Treasuries.

BRICS & PAYMENT SYSTEMS

The BRICS are not working on an alternative currency.

They have a currency they use. It’s gold.

They don’t need another currency.

They can do their transactions between themselves and then at the end of a period of time they can settle out the difference with gold.

They ARE working on an alternative payment system.

They’re making their own rails, payment and clearance system that the US cannot cut off.

It still has US dollars, and also has local currencies, but it is not part of a system that the US can have power over.

STABLECOIN DANGERS

FRAUD

Stablecoins could create the greatest financial catastrophe because it’s not transparent.

The companies that issue them are mainly unregulated and have not been audited to make sure they hold high quality collateral like US Treasuries.

Jim is not accusing anyone specific of fraud, where they could take the dollars from those who buy their stablecoins, and just steal the money without buying the Treasuries to back the stablecoins.

Jim isn’t accusing anyone of anything, but believes human nature says one of the stablecoin companies is likely to do this.

And if they do, what will be the result?

He believes that if this happens it could cause a financial panic and contagion.

FINANCIAL CRISIS

Even without an outright fraud, Jim believes there will come a time where there is a financial crisis, and people who own the stablecoins will all want their money out at the same time.

Jim believes stablecoins will have a run on them just like a classic run on a bank.

He believes they are basically Money Market Funds (MMFs).

And in the 2008 Financial Crisis, the Fed froze the commercial paper market and the money markets, and they bailed out the banks.

The Fed is probably not going to bail out the stablecoin market, so there would be a financial panic bigger than anything we’ve seen.

The Treasury market would seize up.

People would want their money out and there would be a run.

Stablecoin creators would be selling Treasuries to redeem the stablecoins for fiat.

But they won’t be able to get enough money out.

VIETNAM

Vietnam recently had more than 86 million bank accounts frozen or erased as a “security measure”.

This is centralized digital control.

Vietnam is communist.

CBDCs

Central Bank Digital Currencies are sold as a convenience, but if you use this then the government knows everything about you, including what books you buy, what religion you are, what groups you contribute to.

Everything you buy is tracked on a digital ledger if you use a CBDC.

If a government doesn’t like what you’re doing they have the power to “debank” you.

There is research and development going on at the banking level to create CBDCs.

THE INDIVIDUAL

Jim recommends having some physical gold, some good quality cash in the form of bank deposits, Treasuries, and other hard assets like real estate, which are not central bank assets.

Jim’s X handle is @RealJimRickards

……………………………………….

Thank you to Jim Rickards for including me in his New York Times bestselling book The New Case for Gold.

……………………………………….

Nothing on this site is intended as individual investment advice. We’re all watching which way the wind is blowing.

……………………………………….

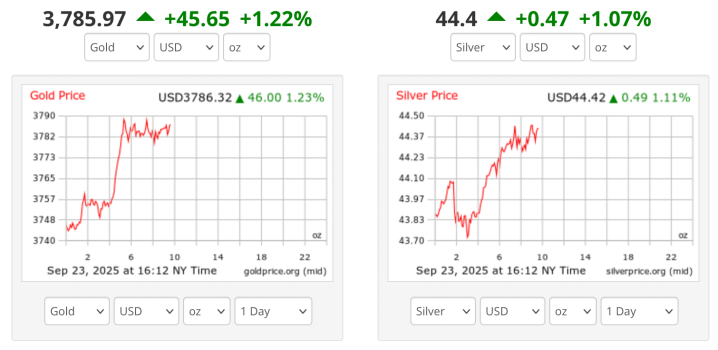

Gold is at historic highs because trust in government and the system is at historic lows.

Communication Theory….

As the alphabet took the magic of words and divided them into tiny repeatable units, strung along in written symbols that did not look like the sound, then reformed into words and meaning in the quiet of one’s own mind, so currency separates commodities and items of value into concise repeatable units.

The currency is packaged and shipped, identical, and is value as exchange for meaning of value to the receiver.

The oral societies are not led by the alphabet; they are led by the voice and ear. So each item is different, unique, and exchange is bartered over for each unit. These countries will not easily move to digital wallets and identical purchases. The unbanked are sometimes unbanked by choice.

Those in power talk about taking care of the ‘unbanked’. But the care is misplaced. A new bank account will earn the banker fees, and the expansion of the currency supply is not a desire of the central banking system, it is its lifeblood.

If the unbanked have a devise with a digital wallet then they can be tracked as data and aggregated for easier control. A retail CBDC in the unbanked hands can be programmed by the central authority to be used to the benefit of the center.

To keep their central bank system going they must have ever expanding borrowing and debt.

Their system has failed because it has to fail.

Sooner or later you run out of people to lend to, so they need to add the unbanked, and they’ve created a ‘green’ issue to make new reasons to create more debt.

The business cycle cannot be stopped; it rises and falls as every closed system does. They know this, and so those in power are rushing to cement control with new technology before the first out of the gate with new products beat them to market share. The rush is to try to regulate to keep the status quo.

But it’s impossible.

AI is the new race.

Humans want to control the data inputed believing their own control will keep them in control. No one has any idea what complex financial instruments will be created by generative AI. Controlled by itself. For whose benefit?

My biggest concerns at the moment come from Understanding Media, written by Marshall McLuhan. He writes of Nobel prize winning author Alias Canneti’s book, Crowds and Power, talking about the psychic effects of the Germany hyperinflation after the First World War.

The depreciation of the citizen went along with that of the German Mark.

There was a loss of face and of worth, in which the personal and the monetary units became confused.

When everything is mechanical, it includes thoughts, money and humans.

I hope that confusion doesn’t return.

Elaine~

……..

Thank you to Mike Maloney for including me in Episode 1 of his bestselling series Hidden Secrets of Money.

Coins and Crowns

words and music Elaine Diane Taylor

SOCAN/ASCAP

from the album Coins and Crowns

Coins and Crowns is featured in Episode 1 of Mike Maloney’s bestselling series Hidden Secrets of Money.

……………………………………….

Not Much of a Holiday (Bank Holidays and Media Persuasion)

words and music Elaine Diane Taylor

Single available on iTunes

……………………………………….

A Terrible Breeze (War and Social Media)

The news comes down

A little bluebird sings

Words of war

Fire and furious things

Of testing might

‘Til no patience knows

If keeping still

Still keeps you safe at home

It’s a terrible breeze

They speak of today

Of threats that used to live a world away

We all know wind

Can blow both ways

And a terrible breeze can blow it all away

A worldwide net

Sees our village grow

Until we all forget

What each one used to know

How a blind bird’s wings

Can reach the shore

And turn the wheel of peace and war

Village fools sinking down, down, down

Debt and gold wound in numbered shrouds

Deal of a life it’s bread and clowns

Can we afford another go around?

The news comes down.

It’s a terrible breeze. The news comes down.

words and music Elaine Diane Taylor

Single available on iTunes

……………………………………….

Preparing for the Fall is a live boutique album available for digital download — featuring Wag the Dog, Black Swan Dive, American Pie and Gods of the Copybook Headings. Also available on iTunes, Google Music, Amazon Music and major digital distributors.

……………………………………….

The Gods of the Copybook Headings

words by Rudyard Kipling and music by Elaine Diane Taylor

from the album Preparing for the Fall.

The copybooks of the early 1900s gave us all the wisdom we need. The sayings that were copied are the truths, the gods of our world. All the empires who followed the gods of the marketplace have fallen, and there’s terror and slaughter when the gods of the copybook headings return. The lyrics are by Rudyard Kipling. One of my gurus.

Another Week on Wall Street

words and music Elaine Diane Taylor

from the album Coins and Crowns.

“A little grease (Greece) is floating out to sea, and little pigs (Portugal, Italy, Greece and Spain) are bobbing up and down, they’ll send a storm and we’ll see, when the tide goes out who’s naked on the beach“. The world is changing as we know it.

……………………………………….

Nothing on this site is intended as individual investment advice. We’re all watching which way the wind is blowing.

……………………………………….