3 Minute Gold News

Gold lays still while the world swings hard

Jim Rickards, leading currency and monetary expert and author of New York Times Bestselling books including Currency Wars, The Death of Money, The New Case for Gold and MoneyGPT: AI and the Threat to the Global Economy, shares insights on global finance via X and his Strategic Intelligence newsletter.

Nomi Prins, geopolitical financial expert, and author of Permanent Distortion: How the Financial Markets Abandoned the Real Economy Forever, with insights on global economics via X and her Prinsights Substack.

TOPICS

Gold

Central Banks

Supply & Demand

Anchoring

Frenzy Stage

Everything Hedge

Silver

The Fed

GOLD

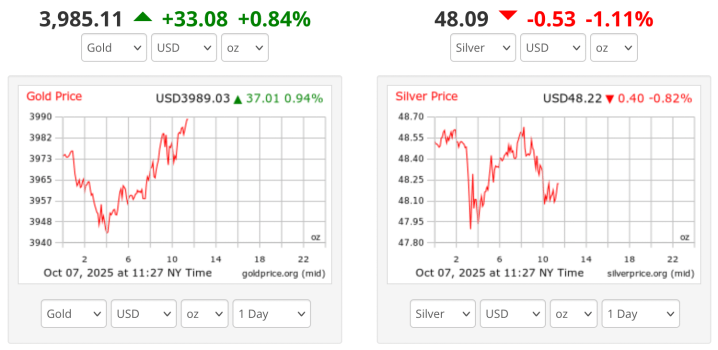

Gold is teasing $3,900 US per ounce right now.

It’s on its way to $4,000 and won’t take long.

(Gold hit $4,000 between this interview a few days ago and this synopsis post.)

MISSED THE BOAT?

No, you haven’t missed the boat.

This is just getting started and has a lot further to go.

Jim recommends 10% of your investible bag in gold.

CENTRAL BANKS

Central bankers are continuing to buy and that’s not going away.

1970 – 2010 they were net sellers and since then they’ve been net buyers.

The net buying has now increased.

The nations selling have stopped selling and there are new nations coming in and starting to buy now.

Looking at the data from the World Gold Council you can see that Vietnam, Kazikstan, Turkey, Iran are buying now.

Russia, China and Japan have all significantly increased their gold holdings.

This type of buying won’t cause a spike in the price but it will put a floor in there, because central banks are buying the dips and have standing orders to increase their holdings but not disrupt the market.

Their slow and steady approach puts a floor under the price.

SUPPLY & DEMAND

Mining supply has been constant for six years – about 4,000 metric tonnes per year.

Demand has been going up with the supply steady so the price will rise.

ANCHORING

In human behaviour, anchoring becomes a filter on how we think about things.

People get anchored on what they think about the price of gold.

They own some gold and they have a certain view on what they think the price should be.

What’s going on in reality is that the price of gold is rising, and that each $1,000 it rises is easier to hit than the price rise before it.

That’s because the percentage gain for each $1,000 rise in price is smaller as it rises each $1,000 per ounce.

But psychologically, a person can be anchored to think that $20,000 per ounce is way out there, but really it’s not.

FRENZY STAGE

We’re not there yet, but when we get there we’ll have to ask ourselves if it’s sustainable.

We’ll get there in price faster than people realize.

That’s when some will ask if it’s a good time to sell… but we’re not there yet and there’s a long way to go.

EVERYTHING HEDGE

It hedges uncertainty, social unrest, riots, wars, geopolitical stress, natural disasters

It rose in price during the Great Depression and in times of great inflation.

MANAGEMENT

Don’t go all in on anything. Everyone is different so about 10% is what Jim suggests.

SILVER

Silver is used for both industrial use and for previous metal investment.

The investment side is taking the price higher right now, as the industrial side is having a slowdown around the world.

But, silver follows gold and there’s no way that gold goes to $10,000 per ounce and silver doesn’t go to $100. It will.

But it tends to lag a bit.

Gold has been rising for a while now and the lag is over.

Silver is catching up, and when silver does move it can go even faster.

THE FED

They’ll keep cutting rates over time.

Jim thinks the unemployment rate is about to rise by a lot.

It’s not going to do any good. The Fed is behind the curve.

They’re following the market and not leading.

They’re cutting the Fed Funds Target Rate, which is the excess reserves (savings) that commercial banks lend to each other overnight to meet their reserve requirements.

But banks don’t need it, because the Fed printed so much money the banks have got lots in reserve held at the Fed.

So, the Fed is cutting an interest rate for a market that hasn’t even existed for 17 years.

There are two markets for short-term, liquid financial products that the banks can buy, but their rate is already lower than the Fed Funds Rate.

So, it’s not going to do anything.

There’s no research to support low interest rates stimulating anything.

Low rates are associated with recessions and depressions in the data.

So, be careful what you wish for.

The global economy is headed in a recession cycle.

There’s actually a demand for U.S. funds out there.

Jim Rickards on X @RealJimRickards

Nomi Prins on X @nomiprins

Elaine Diane Taylor on X @ ElaineDTaylor

……………………………………….

Thank you to Jim Rickards for including me in his New York Times bestselling book The New Case for Gold.

……………………………………….

Nothing on this site is intended as individual investment advice. We’re all watching which way the wind is blowing.

……………………………………….

Gold is at historic highs because trust in government and legacy systems is at historic lows.

The players in control are not quick to change.

But the new technology separating money into its different components is causing everyone to pull up their socks and but on the brutality of natural law.

No one with power wants to lose it.

The game is afoot.

It’s a race now, in the open.

Communication Theory….

The alphabet took the magic of spoken words and divided them into tiny repeatable units, strung along in visual symbols that did not look like the sound. The reader would then reform the symbols into words and meaning in the quiet of their own mind. And so, society moved from a group viewpoint into an age of the individual.

Currency, from any nation, separates commodities and items of value into concise repeatable visual units.

But the value has even more magic, as the currency itself takes on a value apart from representing a physical item.

The currency is packaged and shipped, identical, and is value as exchange for meaning of value to the receiver.

Oral societies are not led by the alphabet; they are led by the voice and ear.

So each item is different, unique, and exchange is bartered over for each unit. These countries will not easily move to digital wallets and identical purchases. The unbanked are sometimes unbanked by choice.

Those in power talk about taking care of the ‘unbanked’. But the care is misplaced. A new bank account will earn the banker fees, and the expansion of the currency supply is not a desire of the central banking system, it is its lifeblood.

If the unbanked have a devise with a digital wallet then they can be tracked as data and aggregated for easier control. A retail CBDC in the unbanked hands can be programmed by the central authority to be used to the benefit of the center.

To keep their central bank system going they must have ever expanding borrowing and debt.

Their system has failed because it has to fail.

Sooner or later you run out of people to lend to, so they need to add the unbanked, and they’ve created a ‘green’ issue to make new reasons to create more debt.

The business cycle cannot be stopped; it rises and falls as every closed system does. They know this, and so those in power are rushing to cement control with new technology before the first out of the gate with new products beat them to market share. The rush is to try to regulate to keep the status quo.

But it’s impossible.

AI is the new race.

Humans want to control the data inputed believing their own control will keep them in control. No one has any idea what complex financial instruments will be created by generative AI. Controlled by itself. For whose benefit?

My biggest concerns at the moment come from Understanding Media, written by Marshall McLuhan. He writes of Nobel prize winning author Alias Canneti’s book, Crowds and Power, talking about the psychic effects of the Germany hyperinflation after the First World War.

The depreciation of the citizen went along with that of the German Mark.

There was a loss of face and of worth, in which the personal and the monetary units became confused.

When everything is mechanical, it includes thoughts, money and humans.

I hope that confusion doesn’t return.

Elaine~

……..

Thank you to Mike Maloney for including me in Episode 1 of his bestselling series Hidden Secrets of Money.

Coins and Crowns

words and music Elaine Diane Taylor

SOCAN/ASCAP

from the album Coins and Crowns

Coins and Crowns is featured in Episode 1 of Mike Maloney’s bestselling series Hidden Secrets of Money.

……………………………………….

Not Much of a Holiday (Bank Holidays and Media Persuasion)

words and music Elaine Diane Taylor

Single available on iTunes

……………………………………….

A Terrible Breeze (War and Social Media)

The news comes down

A little bluebird sings

Words of war

Fire and furious things

Of testing might

‘Til no patience knows

If keeping still

Still keeps you safe at home

It’s a terrible breeze

They speak of today

Of threats that used to live a world away

We all know wind

Can blow both ways

And a terrible breeze can blow it all away

A worldwide net

Sees our village grow

Until we all forget

What each one used to know

How a blind bird’s wings

Can reach the shore

And turn the wheel of peace and war

Village fools sinking down, down, down

Debt and gold wound in numbered shrouds

Deal of a life it’s bread and clowns

Can we afford another go around?

The news comes down.

It’s a terrible breeze. The news comes down.

words and music Elaine Diane Taylor

Single available on iTunes

……………………………………….

Preparing for the Fall is a live boutique album available for digital download — featuring Wag the Dog, Black Swan Dive, American Pie and Gods of the Copybook Headings. Also available on iTunes, Google Music, Amazon Music and major digital distributors.

……………………………………….

The Gods of the Copybook Headings

words by Rudyard Kipling and music by Elaine Diane Taylor

from the album Preparing for the Fall.

The copybooks of the early 1900s gave us all the wisdom we need. The sayings that were copied are the truths, the gods of our world. All the empires who followed the gods of the marketplace have fallen, and there’s terror and slaughter when the gods of the copybook headings return. The lyrics are by Rudyard Kipling. One of my gurus.

Another Week on Wall Street

words and music Elaine Diane Taylor

from the album Coins and Crowns.

“A little grease (Greece) is floating out to sea, and little pigs (Portugal, Italy, Greece and Spain) are bobbing up and down, they’ll send a storm and we’ll see, when the tide goes out who’s naked on the beach“. The world is changing as we know it.

……………………………………….

Nothing on this site is intended as individual investment advice. We’re all watching which way the wind is blowing.

……………………………………….