November 9, 2025

by elainedianetaylor

In the electric age of our interconnected world, Marshall McLuhan whispered a truth as old as the cycles themselves: the medium is the message.

It means we communicate using a medium, whether it’s our live voices, a book, radio, TV or the internet, and that we create an idea, a value, we encode it, send it down that medium, and it’s decoded on the other side by the receiver.

We always think our message is the important part, but McLuhan, one of my gurus, taught that the medium itself is what frames how we think and what we think about. We come up with ideas that fit into the frame of the medium. The medium itself IS the message.

The message is either centralized, going from one source out to many in a one-way direction, or it’s decentralized, moving from anywhere to anywhere and back and forth. We make society around what the medium is, and we think, act, create and exchange value based on our frame.

For example, the book, a medium, allowed citizens to sit in solitude and decipher squiggles on a page into meaning, and to form a private opinion about what they thought of that meaning. Each phonetic letter is strung along visually until it creates meaning, step upon step, so we end with meaning.

Heiroglyphs are a picture with meaning that is understood all at once. As is a meme or a photograph. We decipher instantly. Like electricity, it is either off or on. We don’t build meaning, it’s either there or not.

Radio is a one-way message from a creator to the masses. The elite used to call it the hypodermic needle approach to influencing public opinion and action. They’re still trying the one-way method but it’s not working now we have the internet.

The plural of a medium is called media, and that’s where our word mainstream media comes from. It’s a message sent through a medium from one-to-many with very little or no ability for the receiver to respond or take part in creating the group meaning.

But the internet changed that, and the medium became multi-way many-to-many, dynamic, always changing, and the framing of the messages followed this path.

Niche groups are able to find each other now, communicate directly and instantly without going through a centralized government or business, and create their own value and ideas that mean something to them without pleasing everyone.

MONEY

Money is moving through this swing from centralized to decentralized now.

Central banking’s oldest surviving bank is the Riksbank in Sweden (1668), and the Bank of England (1694) is seen as the model for modern central banking.

But the current system lead by the Bank for International Settlements (BIS) isn’t even one hundred years old. It started in 1930 to work out reparations for Germany to pay after World War I.

That means we’ve been living in that system for most of our lives. Now, through technology, new payment systems are being created digitally that don’t need the central banking system to complete the tasks of payment and reconciliation.

It all happens at once in seconds, cutting out the bank fees and the central bank control.

I read the BIS speeches each morning, and they laughed and belittled the digital financial beginnings. But they aren’t laughing now. They are very worried and desperately trying to catch up and to stay relevant.

The ‘money’ that isn’t in their control is private, like a store’s credits, and doesn’t cover usual money regulations as it’s not fiat central bank nor commercial bank oney, until it is sold from private money into the fiat rails where it’s then counted and taxed. The central banks weren’t concerned when it was small, then it became huge, and now private shadow banking arms are making their own stablecoins, and that is changing the game.

This private money, called stablecoins, is almost all backed by government bonds, virtually all US bonds, where the private company parks the bonds and collects the interest, and makes a one-to-one digital stablecoin that customers use to hold or pay with. So, instead of the commercial banks making the interest on the bonds the private companies do.

Centralized empires rose out of the creation of print. Nation states could then have stable policies that were printed down, and the citizens became one of many, identical and replaceable, The Nation printed edicts, and citizens became uniform soldiers and workers, all the same, fractionalized in steps, like Gutenberg type became uniform, fractionalized and repeated, so the copy you got was exactly the same as the one they got five villages over.

And money? It’s the purest medium of all. It’s a mirror of our collective souls. It’s how we place value and exchange that value.

Money is the inbetween. It’s a metaphor.

See, power gathers in a center and rules from there like spokes reaching out to the edges of a wheel. One way. The wheel turns around its cycles like the earth spinning in seasons. And it all centers from the hub.

But power is the thing humans want more of. And more. And more. So without a cycle of growth and then pruning there’s just growth, at the edge’s expense, until the whole system is bloated and corrupt and weakened from within.

Like any closed system.

Let’s trace the arc. Print centralized us into nation-states and assembly lines, where money became a uniform stamp from the king’s mint or the Fed’s vault.

Post-Gutenberg, it took ~450 years for that centralizing force to peak. About 1450 to the roaring 1900s, when a gold standard tied the currencies to something physical, yet still funnelled it through centralized rails.

But by 1971, Nixon’s shock severed the dollar from gold, birthing pure fiat: a broadcast medium of money, controlled by a handful of central banks.

Ruled and run by a dollar and a gun. Fiat means, “It is because I declare it is.”

Rules flowed one-way, from the center outward, like a radio signal you can’t reply to. That phase? About 100 years (1870s gold standard up to 1980s), then the reversal to decentralized hit.

Enter the decentralized swing: about 50-100 years. From ARPANET’s 1969 whisper to the Internet’s 1991 roar, and then smartphones by 2007 giving an instant reach to everyone.

Citizens all lived on the edge of the wheel, feeling the effects of centralized policy coming at them one-way, with inflation and job losses. Now they had a voice.

Money followed the same shift. Bitcoin’s whitepaper in 2008 wasn’t just code; it was the edge of the wheel pushing back.

Centralized fiat with its endless brrrr printing, brought inflation’s silent tax that killed the trust.

What did the swing of the pendulum bring back?

The tribal barter of oral villages, where value was individual in many-to-many exchanges, immediate and unmediated.

DeFi payment products are the swing to decentralized communication. From peer-to-peer liquidity pools, to yield farming without a bank’s permission slip.

Digital currencies, with stablecoins like USDC, live on a blockchain, a global village ledger where anyone is sovereign.

GOLD

Gold is the bridge across the pendulum swings.

In McLuhan’s lens, it’s the ultimate edge of the wheel asset: decentralized by nature, mined from the earth, unbrandable, hoarded in vaults or hidden in drawers.

No central bank prints it and it can’t be inflated away. During centralizing eras, gold backed the center (Bretton Woods, 1944-1971, 27 years).

Now, in this decentralizing arc (45 years in, 1980-2025 and counting), it’s fleeing toward safe havens. The BRICS nations and central banks and citizens all stacking it like cordwood for winter.

Basel III’s 2025 rollout? This BIS policy forces banks to hold more assets, like physical gold as Tier 1 capital, instead of just making loans out of a sliver of something tangible. This is the hub of the wheel admitting the edges, the decentralized system, holds the real weight.

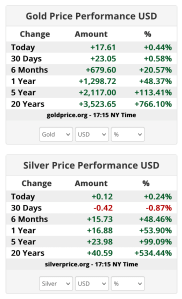

Gold’s price?

Gold’s price is up 30% year-to-date as of this November, whispering that trust in fiat’s one-way broadcast is fading, just as McLuhan predicted when over-centralization alienates the tribe.

The timeline? Just like a pendulum it will swing back when it reaches peak tension. Feels pretty close. The US, as the hub of power, will feel it last.

Centralizing phases last 100-150 years, building legacy bureaucracies. Decentralizing ones accelerate to 50-100, electric feedback loops speeding us forward.

We are now mid-swing. Fiat’s peak centralization (1971-2030?) lasted ~60 years so far, but the edges are already re-centralizing in clever ways. Big Tech has walled gardens (Apple Pay, Google Wallet) and CBDCs like China’s digital yuan, and the ECB’s aim for CBDCs, promise decentralization but chain it to state surveillance and programmability.

You do not want a Central Bank Digital Currency. It is programmed to be changeable at their command, after it’s in your wallet. They can tell you to only spend it on a number of things or in a number of places. In war they could lock it down so they can keep control.

The full reversal to DeFi? By 2035, maybe, when decentralized money eclipses Visa’s volumes, and gold-backed tokens like PAXG become the new village square. War or peace? BRICS or endless dollar hegemony? The medium decides: if central banks get in CBDCs as the new print press, the edge citizen will swing it into something wilder—DAO-governed treasuries, maybe, or neural-linked economies. The new x402 protocol has AIAgents buying and selling with other AIAgents. Maybe we’ll all have Agents that manage and purchase for us on decentralized, private ledgers.

What does it mean, this swing? In McLuhan’s global village, money isn’t just exchange; it’s the grammar of our relations. It dictates how we think.

Centralized, it fragments us into isolated consumers, decoding value in solitude. Decentralized, it retrieves the back and forth of individual products and people. It’s the public sound of bargaining and the agency of co-creation.

DeFi isn’t chaos; it’s rebalancing. Gold isn’t a relic; it’s the steady yardstick beneath the code, reminding us that true value endures the pendulum’s arc.

As empires rise and fall in repeating cycles of math and breath, watch the edges. That’s where the new centers are born.

The future of money? It’s the present, it’s happening now, and it’s echoing in every satoshi and sovereign ounce.

Swing with it, or be swung.

Elaine~

Elaine Diane Taylor is an artist, observer of cycles, and chronicler of gold’s quiet revolution. Her work weaves sound, symbol, and systems into songs and stories. Explore her digital albums on ITunes, YouTube, soon on Spotify, on X @elainedtaylor or follow the gold news thread here.

Elaine Diane Taylor on X @ ElaineDTaylor

……………………………………….

Thank you to Jim Rickards for including me in his New York Times bestselling book The New Case for Gold.

……………………………………….

Nothing on this site is intended as investment advice. We’re all watching which way the wind is blowing.

……………………………………….

Gold is at historic highs because trust in government and legacy systems is at historic lows.

……..

Elaine – Barkerville, Gold Rush Town, British Columbia, Canada

………….

Thank you to Mike Maloney for including my song Coins and Crowns in Episode 1 of his bestselling YouTube series Hidden Secrets of Money.

Coins and Crowns

words and music Elaine Diane Taylor

SOCAN/ASCAP

from the album Coins and Crowns

Coins and Crowns is featured in Episode 1 of Mike Maloney’s bestselling series Hidden Secrets of Money.

……………………………………….

Not Much of a Holiday (Bank Holidays and Media Persuasion)

words and music Elaine Diane Taylor

Single available on iTunes

……………………………………….

A Terrible Breeze (War and Social Media)

The news comes down

A little bluebird sings

Words of war

Fire and furious things

Of testing might

‘Til no patience knows

If keeping still

Still keeps you safe at home

It’s a terrible breeze

They speak of today

Of threats that used to live a world away

We all know wind

Can blow both ways

And a terrible breeze can blow it all away

A worldwide net

Sees our village grow

Until we all forget

What each one used to know

How a blind bird’s wings

Can reach the shore

And turn the wheel of peace and war

Village fools sinking down, down, down

Debt and gold wound in numbered shrouds

Deal of a life it’s bread and clowns

Can we afford another go around?

The news comes down.

It’s a terrible breeze. The news comes down.

words and music Elaine Diane Taylor

Single available on iTunes

……………………………………….

Preparing for the Fall is a live boutique album available for digital download — featuring Wag the Dog, Black Swan Dive, American Pie and Gods of the Copybook Headings. Also available on iTunes, Google Music, Amazon Music and major digital distributors.

……………………………………….

The Gods of the Copybook Headings

words by Rudyard Kipling and music by Elaine Diane Taylor

from the album Preparing for the Fall.

The copybooks of the early 1900s gave us all the wisdom we need. The sayings that were copied are the truths, the gods of our world. All the empires who followed the gods of the marketplace have fallen, and there’s terror and slaughter when the gods of the copybook headings return. The lyrics are by Rudyard Kipling. One of my gurus.

Another Week on Wall Street

words and music Elaine Diane Taylor

from the album Coins and Crowns.

“A little grease (Greece) is floating out to sea, and little pigs (Portugal, Italy, Greece and Spain) are bobbing up and down, they’ll send a storm and we’ll see, when the tide goes out who’s naked on the beach“. The world is changing as we know it.

……………………………………….

Nothing on this site is intended as individual investment advice. We’re all watching which way the wind is blowing.

……………………………………….