The Sound of Money Dying

by Elaine Diane Taylor

November 28, 2025

I woke up early this morning to the same song I’ve been whispering for years: a low acoustic hum, like a tuning fork struck against the ribs of the old monied world.

History is Rhyming

Gold is back up over $4,200, after the central bank world pulled it back for a quick dip from its moon run. Silver is sprinting past $55 and the chart looks like a rocket that forgot gravity exists.

Bitcoin fell in price recently, under $90,000, as the old system tried to execute the leveraged waterfall fear play. It’s back up as well. The headlines scream “volatility.” I hear the death rattle of central banking.

The whole thing.

History is rhyming again, loud. The wheel of power from center to edge is turning.

Always turning.

Remember Rome

Remember Rome in the third century? The denarius started as nearly pure silver. By the time Diocletian was chasing his tail with price controls, it was just a copper disc dipped in silver. The value was diluted by the powerful to try to keep that power.

The people didn’t riot over politics first; they rioted because their money no longer worked as money. When the yardstick shrinks, empires fall.

Here we are. Again.

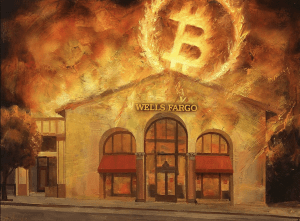

Schaefer & Picasso

The first time I saw one of Alex Schaefer’s canvases, posted here above with links to his socials and work for puchase below, I thought he was catching the physical of the unseen truth. Art sees before the world can swallow the bitter pill.

The first time I saw one of Alex Schaefer’s canvases, posted here above with links to his socials and work for puchase below, I thought he was catching the physical of the unseen truth. Art sees before the world can swallow the bitter pill.

Picasso shattered the human face and body into a thousand angles because the old way of seeing, mechanical, linear, one-thing-after-another, was gone.

In the electric age the lightbulb doesn’t brighten gradually; it flashes ON. Sudden insight. A civilization flips from analog to digital in a heartbeat.

Ideas and value move by electricity now. The medium itself is the message; the message is that we as a society think and communicate in on and off now.

That’s why the elite want to social engineer the masses, as a riot and pitchforks can gather quickly now.

Newspapers used to be published with pages of prose. Leisurely reading in a mechanical world. Then boxes, like frames, with small paragraphs all over the page. Then newspapers died. But money is still mechanical, and those who rule the mechanics want to keep it that way or dominate a new empire.

There’s a saying that Mark Yusko, one of my Bitcoin gurus, tweets out often, that at first they laugh at you, then they fight you, then you win. The central banking system, the BIS as its head, laughed for years.

Coffee with the BIS

I read the Bank for International Settlements speeches every morning and have done for many years, at a cafe set up with my Americano and laptop. Different cities but the same routine for me. What is the dying establishment saying?

I read the Bank for International Settlements speeches every morning and have done for many years, at a cafe set up with my Americano and laptop. Different cities but the same routine for me. What is the dying establishment saying?

They used to say Bitcoin was of no concern so ignore it. They used to say it was used by criminals (as if paper money was not), and that they would just order it to not be used, or outlaw it. They used to tell the commercial banks, quietly, that DeFi and payment companies might take a small piece of their fees but that it would not rock the boat.

Now they are racing to attract private companies to work WITH them. Begging them.

No, it won’t happen. Their mandates do not mix. Also, now the BIS is trying to offer commercial banks a piece of their CBDC scheme to push their own central bank digital currency, more debt-based fiat, fully controllable by the BIS, with added fees for banks. That may or may not depending on the payoffs. I’ll speak more on that soon.

Shadow banking, which is the mutual funds and big companies like Black Rock, have come in with a roar and are eating the world by using private money, like Bitcoin and DeFi currencies, but packaging it themselves into products to get fees from traditional customers and big money (like banks do and JP Morgan and others are racing to do too).

Private Money as Alternative

Bitcoin is the Picasso of money: cubism in code.

Bitcoin is the Picasso of money: cubism in code.

Gold and silver win as physical private money by geological scarcity; rocks that took the universe billions of years to cook. Bitcoin wins by mathematical scarcity; 21 million coins, no more, ever, written in the same language that runs the stars. Same principle, new canvas.

While central banks drown the world in debt, private minds are building the escape hatches.

While central banks drown the world in debt, private minds are building the escape hatches.

Who owns the private monies is another question but doesn’t stop the private citizen from being involved. Digital wallets with a DeFi currency can settle a payment in Pennsylvania from a coffee shop in Prague for less than a penny. In seconds. All legal and all normal.

So banks and traditional powered companies, as well as governments and the central banks are all racing to create products to get those fees and a chunk of the new system they can’t stop.

Stablecoins

Stablecoins move billions past the noses of the old gatekeepers. Growing exponentially. It’s a piece of traditional value held and a digital representative made and moved around as a currency. Private money, like barter, but at the speed of light. All legal as is, so that it goes onto the regular fiat payment rails when the holder cashes out to pay taxes or pay for something with regular fiat money. Some fear a collapse of stablecoins, but the private stablecoin companies are morphing, and growing through competition, a healthy hand of the market.

Stablecoins are backing themselves with gold now, or with short term US Treasuries. The first ones kept the profit from holding those Treasuries, but the new ones, like a product called STBL, offer the investor the profit in the Treasury note that backs the stablecoin they bought. Competition is creating fair market value.

Exploitation

When a system peaks and the creators are dead, the new gatekeepers benefit more from protecting the system than from protecting any victim of wrongdoing. So, this stage in central banking sees an explosion of exploitation. NDAs and payouts. It’s hidden and covered up, and the perpetrators walk free to protect the current system: Too Big to Fail.

This happened with the church and a handful of priests and sexual exploitation. This happens in academia with a handful of predator professors sexually exploiting young students they were mentoring. This happens in corporations, where a small number of predators take advantage of the power differential to exploit and sexually attack a protege who is idealistic and is unable to see warning signs. The gaslighting and pressure to keep quiet or lose the perpetrator’s endorsement is a real threat. Politics is the bottom of the barrell in this scenario. A system must cut off rotten branches and give justice to keep trust by the masses, and to repair holes in the boat.

Anything else and the whole ship eventually sinks.

Anything else and the whole ship eventually sinks.

The current financial gatekeepers do not create, but protect the establishment, and instead fight to keep their own pension, their own fees and advantage and culture. As humans do. No one from the 2008 Great Financial Crash went to jail. So, as with all empires, they rise and then fall, unless their is true turning and new creators are allowed inside the system to make a re-birth.

The wheel turns and this phase is the phase of the dying empire.

The system fails the victims of all kinds of abuses, such as the masses having their money value destroyed because the fiat system itself has peaked and is run by those who can’t create, and who don’t let creators take a penny of their pensions and benefits.

With banking, we’ve seen an odd number of deaths by flying off balconies, like pirates walking the plank, unable to tell their tales again. (See Black Swan Dive)

The banks had a century head start and they spent it picking your pocket with “service fees.”

The New World

The new world doesn’t need their permission.

You could do this today:

You could own some physical gold and silver.

Not paper promises; the actual metal you can bite, weigh, hide, hand to your granddaughter. Gold is the yardstick. Every fiat currency on earth is losing the 100-meter dash against that yellow brick. When the debt tower finally topples (and it will, because compound interest on a finite planet has a bad ending), gold simply refuses to fall with the others. A single one-ounce coin in your pocket will outrun a wheelbarrow of tomorrow’s dollars.

You could own some Bitcoin and some utility DeFi tokens for projects that will run the next system, in a wallet you own and you hold. Digital gold for the electric age. Move value the way you move an email.

It’s what I do without giving you advice on what to do, because I’m not a financial adviser. I’m an artist and a writer.

The greatest transfer of wealth in human history isn’t coming.

It’s here.

The old system will squeeze every penny from the masses until even the passive can’t afford to stay quiet any more.

New technology has brought new options. The new x402 tech is where I’m going now. Will show you all how it can help soon.

I’m painting my own future while the old canvas burns.

I’m writing and singing of the cross over.

See you on the other side of the flash.

Elaine~

Elaine Diane Taylor

Keys: gold, silver, Bitcoin, sovereignty

Songs for today: “Coins and Crowns” unplugged, featured in Mike Maloney’s episode 1 New Secrets of Money viral series on YouTube.

“Black Swan Dive” unplugged, about black swan events that are unplanned for and how an unusual number of bankers have walked the plank. On Youtube at Elaine Diane Taylor. Link.

……………

Links for shoutouts:

Alex Schaefer burning banks series:

- Official Website: paintwithalex.com (opens in new tab) – Original paintings, prints, and designs.

- Saatchi Art Profile: saatchiart.com/paintwithalex (opens in new tab) – Gallery for purchasing artworks, including paintings and sculptures.

- X (Twitter):

- @paintwithalex

- (opens in new tab) – Commentary on art, current events, and crypto/Bitcoin ties.

Mike Maloney’s Hidden Secrets of Money:

- Hidden Secrets of Money – Full Series on YouTube (opens in new tab)

- Direct link to Episode 1 – Currency vs Money (the one that features “Coins and Crowns” unplugged):

- Episode 1 – Currency vs Money (opens in new tab)

Mark Yusko (Founder, CEO & CIO, Morgan Creek Capital Management):

- X (Twitter):

-

@MarkYusko

(opens in new tab) – Verified account (162K+ followers) for market commentary, Bitcoin insights, and alternative investments.

STBL and Founder Reeve Collins (also a Co-Founder of Tether)

- Official Website: stbl.com (opens in new tab) – Main site for the protocol, including dApp for minting USST, documentation, whitepaper, and yield-splitting details.

- Linktree Hub: linktr.ee/stblofficial (opens in new tab) – Central links to Discord, Telegram, trading on exchanges (e.g., Binance, Bybit), and team bios.

- X (Twitter):

@stbl_official

(opens in new tab) – Official account for announcements, launches, and community updates.

There are no paid endorsements. I just follow and admire the creators above.

Elaine Diane Taylor on X @ ElaineDTaylor

……………………………………….

Thank you to Jim Rickards for including me in his New York Times bestselling book The New Case for Gold.

……………………………………….

Nothing on this site is intended as investment advice. We’re all watching which way the wind is blowing.

……………………………………….

Gold is at historic highs because trust in government and legacy systems is at historic lows.

……..

Elaine – Barkerville, Gold Rush Town, British Columbia, Canada

………….

Thank you to Mike Maloney for including my song Coins and Crowns in Episode 1 of his bestselling YouTube series Hidden Secrets of Money.

Coins and Crowns

words and music Elaine Diane Taylor

SOCAN/ASCAP

from the album Coins and Crowns

Coins and Crowns is featured in Episode 1 of Mike Maloney’s bestselling series Hidden Secrets of Money.

……………………………………….

Not Much of a Holiday (Bank Holidays and Media Persuasion)

words and music Elaine Diane Taylor

Single available on iTunes

……………………………………….

Thank you to the late David Crosby for his kind messages, including the message to me on X (formerly Twitter) saying this song, Terrible Breeze, has excellent lyrics and good music, and his encouragement for me to get out there and sing.

A Terrible Breeze (War and Social Media)

The news comes down

A little ex (X) bluebird sings

Words of war

Fire and furious things

Of testing might

‘Til no patience knows

If keeping still

Still keeps you safe at home

There’s a terrible breeze

They speak of today

Of threats that used to live a world away

We all know wind

Can blow both ways

And a terrible breeze can blow it all away

A worldwide net

Sees our village grow

Until we all forget

What each one used to know

How a blind bird’s wings

Can reach the shore

And turn the wheel of peace and war

Village fools sinking down, down, down

Debt and gold wound in numbered shrouds

Deal of a life it’s bread and clowns

Can we afford another go around?

The news comes down.

It’s a terrible breeze. The news comes down.

words and music Elaine Diane Taylor

Single available on iTunes

……………………………………….

Preparing for the Fall is a live boutique album available for digital download — featuring Wag the Dog, Black Swan Dive, American Pie and Gods of the Copybook Headings. Also available on iTunes, Google Music, Amazon Music and major digital distributors.

……………………………………….

The Gods of the Copybook Headings

words by Rudyard Kipling and music by Elaine Diane Taylor

from the album Preparing for the Fall.

The copybooks of the early 1900s gave us all the wisdom we need. The sayings that were copied are the truths, the gods of our world. All the empires who followed the gods of the marketplace have fallen, and there’s terror and slaughter when the gods of the copybook headings return. The lyrics are by Rudyard Kipling. One of my gurus.

Another Week on Wall Street

words and music Elaine Diane Taylor

from the album Coins and Crowns.

“A little grease (Greece) is floating out to sea, and little pigs (Portugal, Italy, Greece and Spain) are bobbing up and down, they’ll send a storm and we’ll see, when the tide goes out who’s naked on the beach“. The world is changing as we know it.

……………………………………….

Nothing on this site is intended as individual investment advice. We’re all watching which way the wind is blowing.

……………………………………….