Synopsis of an interview with Canadian billionaire gold legend and philanthropist Frank Giustra, by Daniela Cambone, Editor-in-Chief at Kitco News.

A coming economic fall-off-the-cliff and explosive rise in gold.

by Elaine Diane Taylor

TOPICS:

Coming Financial Crisis

Recession

Gold

Mining

Life

Time

Cryptocurrencies

Silver

U.S. Stock Market

Olive Oil

Gold

Interview link

COMING FINANCIAL CRISIS

We are headed into another financial crisis and it will most likely be worse than 2008.

We’re headed into darker times than 2008.

We’re in uncharted waters and living in a global debt bubble.

Any time you get a debt bubble of this magnitude that is global and fuelled by speculation then something is going to happen.

Things are overvalued.

The pricing isn’t correct because we’ve had $25 trillion of quantitative easing (QE) around the world in the last 10 – 15 years that’s been bought by central banks.

It has fuelled massive speculation and a debt bomb that has doubled since the 2008 crisis.

RECESSION

A recession is starting already.

The powers-that-be already know that it’s coming.

Global growth is slowing and we’re overdue.

You can’t stop recessions. They happen.

Since the Crash of 2008 it’s been the longest running economic recovery in history.

You can see the central banks, including the Fed, are starting to ease.

It’s coming.

When it comes you have to ask yourself, “What might happen that will unravel some of this wild speculation?”

GOLD

Frank has been writing and speaking about gold since 2001.

In 2001, when gold was $250 U.S. per ounce, he saw the change in the monetary policy of the Federal Reserve.

The Fed’s behaviour started to change in the late 1990s and early 2000s, when Alan Greenspan was the Chair.

They began using easy money to come to the rescue of every financial crisis.

All that easy money encouraged bad behaviour and created the start of moral hazard (where a party would take on too much risk because they were protected from personal loss).

Moral hazard is like a gateway drug.

At first you think it’s okay in small amounts but then people start to get reckless.

That policy change and the moral hazard ramped up and created the Crash of 2008.

Frank didn’t predict that we’d have a depression at that time as many people thought. He believed that the Fed would print money which would create a floor in the economic system. He predicted we would pay the price for the money printing later, and that gold would have a run up. (He was correct on both points.)

Gold had a bull run at that time until 2011.

We are now in the third and final phase of the gold market that started in 2001.

This will be the most explosive phase for gold.

The third phase started when the global central banks stopped raising interest rates.

You could see it coming because it was impossible for the central banks to normalize interest rates. If they had raised rates to the normal 4 – 5%, then it would have imploded the whole system.

So, when the central banks paused raising rates it rang the bell for the beginning of the next phase in gold.

And when they dropped rates then it started the beginning of the really big run in gold.

MINING

It’s possible to make a substantial amount of money in the mining industry but you have to be careful.

Mining investment is risky, and especially with junior mining and exploration.

All you can do in that business is to back management companies that are honest and don’t over-promote, and that have done it right many times before.

That’s the only thing you can do with exploration. And even then you’re taking a risk because it’s Mother Nature.

LIFE

There are five things to having a balanced life: family, adventure, learning new things all the time, giving to others, and being passionate about what you do.

Having adventures where you’re learning new things, and that scares you a bit keeps you alive.

You need to challenge yourself and scare yourself once in a while.

TIMING

This is going to be an explosive gold market.

Most gold investors are rooting for a higher gold price but be careful what you wish for.

Franks believes that if things play out the way he is predicting then this is going to be a very ugly world to live in.

These things usually lead to hyperinflation or some sort of a collapse.

With those things come geopolitical conflict, social conflict, massive unemployment and lots of craziness.

People should dust off the history books and take a look at what’s happened in the past when these things have taken place.

It’s not pretty.

Gold is insurance. Everyone should have it in their portfolio.

But don’t relish the world we’ll live in if gold goes up through the roof.

CRYPTOCURRENCIES

Crypto is interesting. It’s not going away but Frank says he’d rather be in gold.

He’s had the debates with crypto people but believes that gold is physical and so you can’t hack it.

In an environment where a cryptocurrency challenges a sovereign currency in any dangerous way then the cryptocurrency will be taken out.

GOLD

Gold is a currency and always has been.

Look at the way central banks are buying the metal and you can’t deny that it’s a currency.

SILVER

Silver will go for the ride up and tag along with gold.

At some point it will outperform gold as it always does.

It’s more volatile than gold but silver will track the yellow metal.

If some day gold pulls back then silver will pull back even more.

US EQUITIES

Frank is not involved in any US stocks. We’re way overdue for a correction.

This market has almost doubled since the highs before the 2008 Crash, and it’s up 300% from pre-Crash lows.

It’s been fuelled by massive amounts of free money and the market is overextended.

Ray Dalio talked about the paradigm shift and nailed it.

Dalio said:

1. The market behaves in a certain way for a long period of time.

2. Things get popular and then people get overextended.

3. It goes on for so long that people think it will never end.

4. And then they get hurt.

This market has been in a long, long run and moral hazard is out of control.

There are two incorrect things that people have been conditioned to believe:

1. Buy on dips.

People believe if there’s a correction or crash then you should buy because it will rebound shortly.

2. The Federal Reserve will always come to the rescue.

People forget that there were long bear markets. The 1969 bear market lasted until 1982. The 1929 bear market lasted almost a decade.

We’re overdue for a bear market, and a 30% correction is easy to see. It could be a lot more than 30% and it could stay down for a very long time.

This is the longest running bull market in history and it’s fuelled by cheap money.

OLIVE OIL

At Frank’s website www.frankgiustra.com he has a blog about a pesto made from the leaves of the rabe broccoli with roasted peppers and his olive oil. To die for. :)

Here’s the recipe page.

GOLD

Here’s Frank’s article from July 9, 2019 Gold: The Unfortunate Final Refuge.

You can find Frank Giustra at www.frankgiustra.com and on Twitter.

……………………………………….

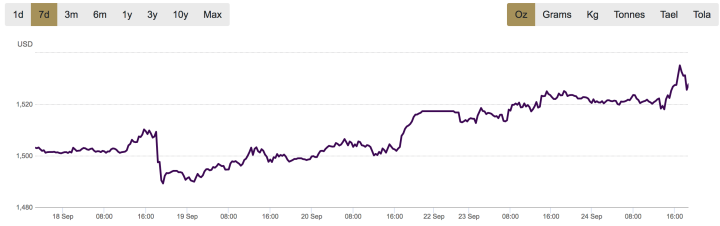

Here’s How Gold Moved This Week:

It looks like the floor of $1,500 U.S. per ounce has become a new floor of $1,520. We’ll see.

At the moment gold is at $1,529/oz

……………………………………….

My thoughts…

When I started researching and writing about gold in 2000ish there were so few who saw a shift coming. When the 2008 Crash came I just thought it was a little pull back and the real change was still on its way. It would be world changing. A shift in how we thought and functioned day to day.

New technology which would bring a new power struggle.

Pendulum’s swing. The mechanical age reached its limit and the electric age has begun its effect.

The mechanical age of Gutenberg type, production lines and rational thought was based on the straight line. We read phonetically instead of symbolically. Letters were reproduced in small, individual chunks. Then everything including our thoughts were divided into tiny chunks. Mechanical cars travelled on straight lined roads. Our minds came to conclusions through a series of steps. The turtle reached the finish line by being slow and steady. We got over….there….by taking one step at a time.

The electric age of radio, television, internet and computers is all about a field of information. All at once. Learning comes with bursts of insight instead of a steady layering of lessons. The electric light bulb threw out a field of light, and suddenly the day went into the night and time itself was changed. We travel the internet and we’re “there” now. We think in symbols and learning comes by phase transitions.

One thing becomes another completely different thing. Media is produced in fields. No longer one-to-many, but now many-to-many. The hare does not win and the turtle does not win. There is no race.

What is coming is a change in technology, which will change the whole environment including how we think. The media IS the message said Marshall McLuhan. The media we use frames what we think about and how we think about it. New tech – a hammer, a wheel, magnetic, vortexes, acoustics, fusion. Like how a stirrup on a horse created a knight by combining human and vehicle, thus changing warfare and the structure of the world, the community and the idea of “us” and “them”. All new tech brings the social field of ruler and ruled in sharp focus.

Ages old story.

The game of Coins and Crowns.

If one can see when the pendulum is about to swing back with force perhaps they can either leap out of the way or use the force and surrounding tension to their best advantage.

The pie is not being divided now. That’s done.

A new pie is being baked in secret. Shhhhh. “They” want it all before you even get a whiff of the sweet aroma.

It has to do with gold. And other things as well. That’s why Frank was smiling in the interview, before he and Daniela got “back to work”.

Maybe all together we’ll just bake a new and bigger pie. ;)

Elaine~

……………….

We all do no end of feeling and we mistake it for thinking. And out of it we get an aggregation which we consider a boon. Its name is public opinion. It’s held in reverence. Some think it the voice of God. – Mark Twain

Everything changes. But gold changes the slowest. ;) Elaine~

World Without an Anchor

words and music | Elaine Diane Taylor

©2019 Elaine Art & Media

ASCAP/SOCAN

Single available on iTunes.

In a world without an anchor

you’re subject to the sea

Right before a tempest

Left screaming at the breeze

Walls of rage and water will test what you have learned,

That in a world without an anchor coins will toss and boats will burn.

Will there be ships that lie deep (in) state beyond (the) reach?

Who will wear a yellow vest?

Who will wash up on the beach?

In a world of flags and spices

we were playing pipes and drums

Sailing on the seas

and selling souls and sums

The gold sailing one way

and silver in return

But in a world without an anchor

we’ll all drown in debt in turn

Will there be ships that lie deep in state beyond the reach?

Who will wear a yellow vest?

Who will wash up on the beach?

In a world of borrowed soldiers

the captain’s damage owed

The treasure chests are missing

and the golden anchor sold

We are fed with cake and follies

We are tethered to the shell

Bailing out the breaches

We’re now bailing in the hell

Will there be ships that lie deep in state beyond the reach?

Who will wear a yellow vest?

Who will wash up on the beach?

from “World Without an Anchor”

……………………………………….

Not Much of a Holiday

words and music Elaine Diane Taylor

© 2015 Intelligentsia Media, Inc. All rights reserved.

SOCAN/ASCAP

Single available on iTunes

Bank holidays and long lines at ATMs to get enough for the day. Debt deals behind closed doors. The media telling us what to believe. China building islands in the South China Sea and claiming all the international waves. Markets close and rockets crash. Silken road, treasure, files hacked. Oil, fusion cold. News and nations all sold. More dealing to come. More standing in line for those who owe. Who owes? There’s a long line of nations in debt and this is far from done.

……………………………………….

Preparing for the Fall live boutique album available on iTunes — featuring Wag the Dog, Black Swan Dive, American Pie and Gods of the Copybook Headings.

……………………………………….

Coins and Crowns

words and music Elaine Diane Taylor

© Intelligentsia Media Inc. All rights reserved.

SOCAN/ASCAP

from the album Coins and Crowns available on iTunes

Single featured in Episode 1 of Mike Maloney’s documentary series Hidden Secrets of Money.

The costs go up and the jobs go down. Hunger goes up and hope goes down. Then anger goes up and it all goes down.

……………………………………….

One thought on “3 Min. Gold News – Frank Giustra with Daniela Cambone of Kitco News – Sept. 24, 2019”