3 Minute Gold News

A Quick Read for Busy People

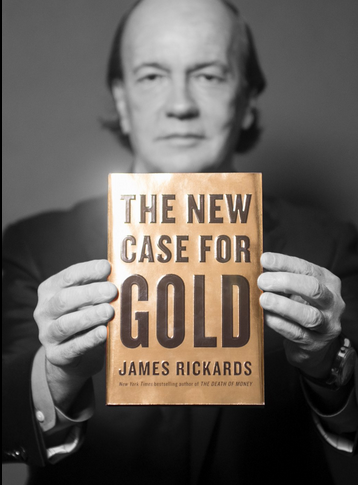

A synopsis of an interview with Jim Rickards, New York Times bestselling author of The Death of Money, Currency Wars, and the newly released bestseller The New Case for Gold by Ross Norman at Sharps Pixley.

Jim is the editor of Strategic Intelligence, Chief Global Strategist for West Shore Funds, former general counsel for Long Term Capital Management, and a consultant to the U.S. Intelligence community and U.S. Department of Defense.

by: Elaine Diane Taylor

Topics:

Brexit

Gold

Jim Rickards

Interview Link

Gold will probably go much higher than it’s at right now.

It’s the inverse of the strength of the currency. So if you have a strong dollar then you have a lower dollar price for gold, and if you have a weak dollar then you have a higher dollar price for gold.

Jim sees the U.S. dollar, the pound sterling and the euro all getting weaker against gold.

They might fluctuate against each other but people around the world are losing confidence in central bank money. When you lose confidence in central bank money you look for other kinds of money, and gold is the best.

BREXIT

Brexit is a significant event but there’s always something down the road. There will be other negotiations, other new treaties and other new governments. Those things will create interest in gold.

FUNDAMENTALS

The fundamentals away from politics are all in favour of gold.

Jim just came to London from Switzerland, where he learned that some of the big gold refiners are having trouble getting dore, which is unrefined gold from the mines. (Here’s a 2011 article from CNBC giving an overview of how the gold biz works.)

There are shortages of supply and at the same time a waiting list of buyers. The way to resolve this is a higher price for gold.

SHARPS PIXLEY

Sharps Pixley is a bank of gold in London. This is the way banking used to be. People walk up to the teller and buy gold. They can store it there at Sharps Pixley or they can take it with them.

In 1840 you could have done the same thing at any bank in England. You could have walked in and handed over your Bank of England notes and they would have given you gold.

Sharps Pixley is nineteenth century banking but it may be twenty first century banking also.

The average life of a currency that’s not backed by gold is around 30 – 40 years.

The reason pound sterling has been around for 680 years is because it was backed by gold. It’s the same thing with the U.S. dollar up until 1971.

If you start the clock at 1971 when the U.S. went off the gold standard, the fiat dollar is about 45 years old, so we may be coming to the end of that paper money.

In the world of negative interest rates gold is the high yield assets. Gold has zero yield, but zero is higher than -1.

A financial crisis can make a person re-evaluate having gold in physical form, but cyber financial warfare can also make them consider owning physical gold.

Bangladesh, one of the poorest countries in the world, had $80 million on deposit with the Federal Reserve Bank in New York — arguably the safest bank in the world.

The $80 million disappeared about two months ago.

If Bangladesh had had gold they would still have their wealth.

The dollar, the euro and the yen are all forms of money. Bitcoin is also a form of money. So is gold.

Jim doesn’t think of gold as a commodity or an investment — it’s a form of money.

But physical gold cannot be hacked.

When people say they have stocks and bonds they really have electrons, which can be hacked and wiped out.

The New Case for Gold is available at Amazon.

Jim Rickards can be found on Twitter and at James Rickards Project.

……………………………………….

Gold is $1,268.20

While hiking in the desert in Nevada I came across a bird’s nest. Here, even in the harshest climate, there’s a way to protect and nurture what’s valuable.

Elaine Diane~

……………………………………….

Not Much of a Holiday

words and music Elaine Diane Taylor

© 2015 Intelligentsia Media, Inc. All rights reserved.

SOCAN/ASCAP

Single available on iTunes

The Greek bank holiday and long lines to get a few euros for the day. Debt deals behind closed doors. The media telling us what opinions to have. China building islands in the South China Sea and claiming all the international waves. More dealing to come. More standing in line for those who owe. Who owes? There’s a long line of nations in debt and this is far from done.

……………………………………….

Preparing for the Fall live boutique album available on iTunes — featuring Wag the Dog, Black Swan Dive, American Pie and Gods of the Copybook Headings.

……………………………………….

Coins and Crowns

words and music Elaine Diane Taylor

© Intelligentsia Media Inc. All rights reserved.

SOCAN/ASCAP

from the album Coins and Crowns available on iTunes

Single featured in Episode 1 of Mike Maloney’s documentary series Hidden Secrets of Money.

When a nation leaves the gold standard and sound money, and borrows to go to war, then hunger goes up, hope goes down, anger goes up, then it all goes down.

The Gods of the Copybook Headings

words by Rudyard Kipling and music by Elaine Diane Taylor

©2014 Intelligentsia Media Inc.

SOCAN/ASCAP

from the album Preparing for the Fall available on iTunes

The copybooks of the early 1900s gave us all the wisdom we need. The sayings that were copied are the truths, the gods, of our world. All the empires who followed the gods of the marketplace instead have fallen, and there’s terror and slaughter when the gods of the copybook headings return. The lyrics are by Rudyard Kipling. One of my gurus.

Another Week on Wall Street

words and music Elaine Diane Taylor

© 2013 Intelligentsia Media Inc. All rights reserved.

SOCAN/ASCAP

from the album Coins and Crowns available on iTunes

See the bankers wave their Wall Street wands and conjure piles of paper green. Naked short selling is like betting that your neighbour’s house will burn down. But in this scenario it happens to burn down. If the bankers win then we lose the whole world as we know it. I wrote this in 2009, with a lyric “A little grease (Greece) is floating out to sea, and little pigs (Portugal, Italy, Greece and Spain) are bobbing up and down, they’ll send a storm and we’ll see, when the tide goes out who’s naked on the beach“, and it’s coming on now. The world is changing as we know it.

……………………………………….